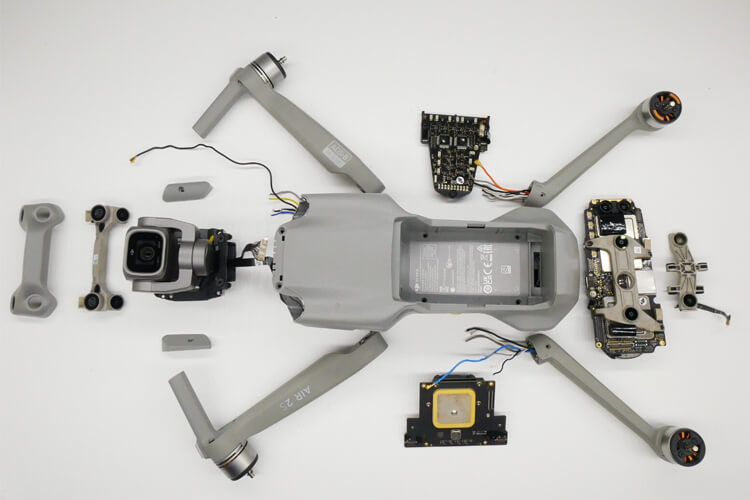

The DJI Mavic Air 2, priced at $749, has recently undergone one of the most detailed teardowns yet. While the first teardown came from iFixit, a more in-depth analysis was carried out by Tokyo-based Fomalhaut Techno Solutions in collaboration with Nikkei Asian Review. Their findings reveal surprising insights into how DJI designs, sources, and manufactures one of its most popular consumer drones.

Off-the-Shelf Components Drive Cost Efficiency

According to the Nikkei report, around 80% of the Mavic Air 2’s 230 components are standard, off-the-shelf parts, commonly used in smartphones, PCs, and other electronic devices. For example, its high-quality camera module shares similarities with components used in flagship smartphones, while the GPS receiver is built with parts typically found in smartwatches.

This heavy reliance on widely available components helps DJI maintain low material costs, estimated at just $135, while still delivering premium drone performance. Among all the parts, only a few—such as the battery, camera, and select sensors—cost more than $10 each.

Why DJI Relies on Standard Parts

DJI controls nearly 70% of the global drone market, which allows them to purchase electronic components in bulk at competitive prices. Instead of developing custom chips for every function, DJI strategically uses proven components, reducing both R&D time and costs. This approach ensures reliability while maximizing profitability.

International Supply Chain and Trade Challenges

Despite being a Shenzhen-based company, not all Mavic Air 2 parts are manufactured in China. For example, the battery management chips are supplied by Texas Instruments and the radio signal amplifier comes from Qorvo, both U.S.-based companies. However, as the U.S.-China trade tensions continue, DJI may face future challenges in securing American-made components, potentially reshaping its supply chain and pricing strategy.

The Real Value: Software and Patents

While the hardware cost is relatively low, much of the Mavic Air 2’s retail price comes from software, R&D, patents, and advanced flight technologies. DJI holds more than 185 UAV-related patents in Japan alone, three times more than its nearest competitor. This strong intellectual property portfolio gives DJI a significant edge in autonomous flight control, obstacle avoidance, and image stabilization systems.

What This Means for Buyers and the Drone Market

For consumers, the $749 price tag reflects more than just hardware—it represents DJI’s investment in software innovation, flight safety, and user experience. However, the combination of tariffs, rising trade restrictions, and supply chain dependencies could influence future pricing and availability of DJI drones in the U.S. and other markets.